Backtest Orbit Model¶

In this section, we will cover:

How to create a TimeSeriesSplitter

How to create a BackTester and retrieve the backtesting results

How to leverage the backtesting to tune the hyper-paramters for orbit models

[1]:

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

plt.style.use('ggplot')

import orbit

from orbit.models.lgt import LGTMAP, LGTAggregated

from orbit.models.dlt import DLTMAP

from orbit.diagnostics.backtest import BackTester, TimeSeriesSplitter

from orbit.utils.dataset import load_iclaims

import warnings

warnings.filterwarnings('ignore')

[2]:

assert orbit.__version__ == '1.0.12'

[3]:

# load log-transformed data

data = load_iclaims()

The way to gauge the performance of a time-series model is through re-training models with different historic periods and check their forecast within certain steps. This is similar to a time-based style cross-validation. More often, we called it backtest in time-series modeling.

The purpose of this notebook is to illustrate how to “backtest” a single model using BackTester

BackTester will compose a TimeSeriesSplitter within it, but TimeSeriesSplitter is useful as a standalone, in case there are other tasks to perform that requires splitting but not backtesting. TimeSeriesSplitter implemented each ‘slices’ as genertor, i.e it can be used in a for loop. You can also retrieve the composed TimeSeriesSplitter object from BackTester to utilize the additional methods in TimeSeriesSplitter

Currently, there are two schemes supported for the back-testing engine: expanding window and rolling window.

expanding window: for each back-testing model training, the train start date is fixed, while the train end date is extended forward.

rolling window: for each back-testing model training, the training window length is fixed but the window is moving forward.

Create a TimeSeriesSplitter¶

There two main way to splitting a timeseries: expanding and rolling. Expanding window has a fixed starting point, and the window length grows as we move forward in timeseries. It is useful when we want to incoporate all historical information. On the other hand, rolling window has a fixed window length, and the starting point of the window moves forward as we move forward in timeseries. Now, we will illustrate how to use TimeSeriesSplitter to split the claims timeseries.

Expanding window¶

[4]:

# configs

min_train_len = 380 # minimal length of window length

forecast_len = 20 # length forecast window

incremental_len = 20 # step length for moving forward

[5]:

ex_splitter = TimeSeriesSplitter(data, min_train_len, incremental_len, forecast_len,

window_type='expanding', date_col='week')

[6]:

print(ex_splitter)

------------ Fold: (1 / 3)------------

Train start index: 0 Train end index: 379

Test start index: 380 Test end index: 399

Train start date: 2010-01-03 00:00:00 Train end date: 2017-04-09 00:00:00

Test start date: 2017-04-16 00:00:00 Test end date: 2017-08-27 00:00:00

------------ Fold: (2 / 3)------------

Train start index: 0 Train end index: 399

Test start index: 400 Test end index: 419

Train start date: 2010-01-03 00:00:00 Train end date: 2017-08-27 00:00:00

Test start date: 2017-09-03 00:00:00 Test end date: 2018-01-14 00:00:00

------------ Fold: (3 / 3)------------

Train start index: 0 Train end index: 419

Test start index: 420 Test end index: 439

Train start date: 2010-01-03 00:00:00 Train end date: 2018-01-14 00:00:00

Test start date: 2018-01-21 00:00:00 Test end date: 2018-06-03 00:00:00

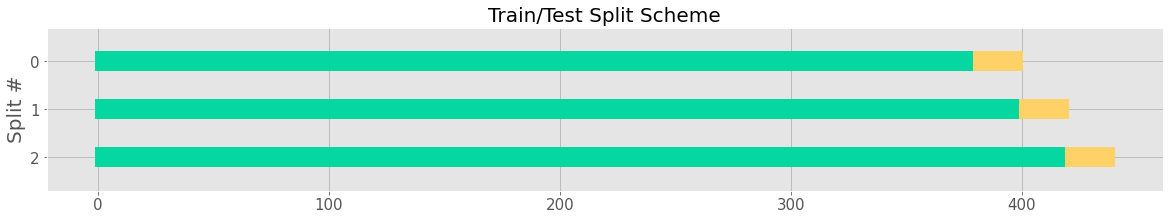

We can visualize the splits, green is training window and yellow it the forecasting windown. The starting point is always 0 for three splits but window length increases from 380 to 420.

[7]:

_ = ex_splitter.plot()

Rolling window¶

[8]:

# configs

min_train_len = 380 # in case of rolling window, this specify the length of window length

forecast_len = 20 # length forecast window

incremental_len = 20 # step length for moving forward

[9]:

roll_splitter = TimeSeriesSplitter(data, min_train_len, incremental_len, forecast_len,

window_type='rolling', date_col='week')

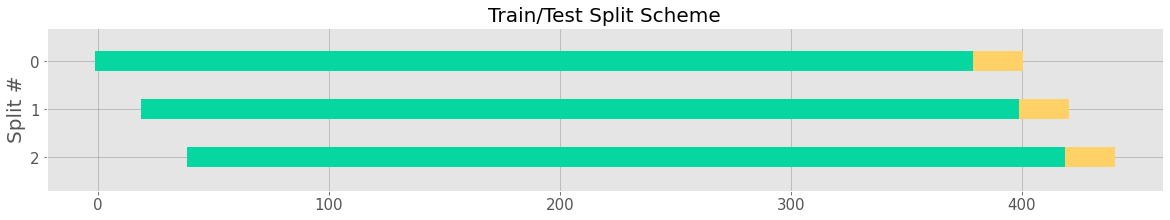

We can visualize the splits, green is training window and yellow it the forecasting windown. The window length is always 380, while the starting point moves forward 20 weeks each steps.

[10]:

_ = roll_splitter.plot()

Specifying number of splits¶

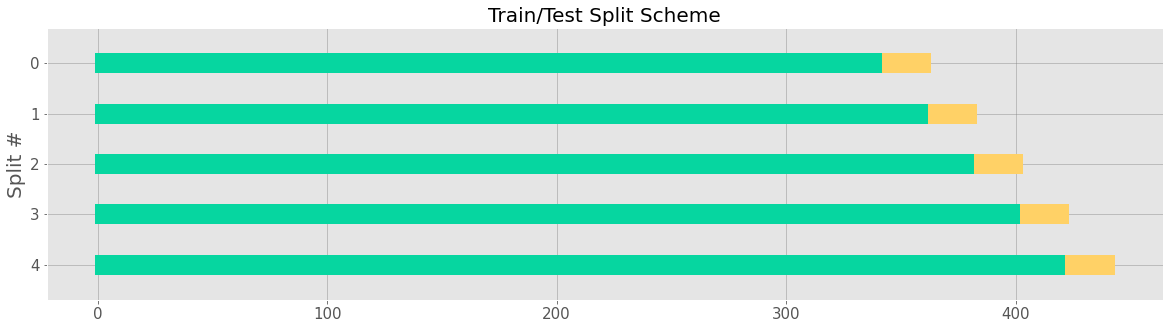

User can also define number of splits using n_splits instead of specifying minimum training length. That way, minimum training length will be automatically calculated.

[11]:

ex_splitter2 = TimeSeriesSplitter(data, min_train_len, incremental_len, forecast_len,

n_splits=5, window_type='expanding', date_col='week')

[12]:

_ = ex_splitter2.plot()

TimeSeriesSplitter as generator¶

TimeSeriesSplitter is implemented as a genetor, therefore we can call split() to loop through it. It comes handy even for tasks other than backtest.

[13]:

for train_df, test_df, scheme, key in roll_splitter.split():

print('Initial Claim slice {} rolling mean:{}'.format(key, train_df['claims'].mean()))

Initial Claim slice 0 rolling mean:12.712341458856958

Initial Claim slice 1 rolling mean:12.67144746151623

Initial Claim slice 2 rolling mean:12.64657747604057

Create a BackTester¶

Now, we are ready to do backtest, first let’s initialize a DLT model and a BackTester. You pass in TimeSeriesSplitter parameters to BackTester.

[14]:

# instantiate a model

dlt = DLTMAP(

date_col='week',

response_col='claims',

regressor_col=['trend.unemploy', 'trend.filling', 'trend.job'],

seasonality=52,

)

[15]:

# configs

min_train_len = 100

forecast_len = 20

incremental_len = 100

window_type = 'expanding'

bt = BackTester(

model=dlt,

df=data,

min_train_len=min_train_len,

incremental_len=incremental_len,

forecast_len=forecast_len,

window_type=window_type,

)

Backtest fit and predict¶

The most expensive portion of backtesting is fitting the model iteratively. Thus, we separate the api calls for fit_predict and score to avoid redundant computation for multiple metrics or scoring methods

[16]:

bt.fit_predict()

Once fit_predict() is called, the fitted models and predictions can be easily retrieved from BackTester. Here the data is grouped by the date, split_key, and whether or not that observation is part of the training or test data

[17]:

predicted_df = bt.get_predicted_df()

predicted_df.head()

[17]:

| date | split_key | training_data | actuals | prediction | |

|---|---|---|---|---|---|

| 0 | 2010-01-03 | 0 | True | 13.386595 | 13.386595 |

| 1 | 2010-01-10 | 0 | True | 13.624218 | 13.640713 |

| 2 | 2010-01-17 | 0 | True | 13.398741 | 13.375456 |

| 3 | 2010-01-24 | 0 | True | 13.137549 | 13.151983 |

| 4 | 2010-01-31 | 0 | True | 13.196760 | 13.196775 |

Users might find this useful for any custom computations that may need to be performed on the set of predicted data. Note that the columns are renamed to generic and consistent names.

Sometimes, it might be useful to match the data back to the original dataset for ad-hoc diagnostics. This can easily be done by merging back to the orignal dataset

[18]:

predicted_df.merge(data, left_on='date', right_on='week')

[18]:

| date | split_key | training_data | actuals | prediction | week | claims | trend.unemploy | trend.filling | trend.job | sp500 | vix | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2010-01-03 | 0 | True | 13.386595 | 13.386595 | 2010-01-03 | 13.386595 | 0.219882 | -0.318452 | 0.117500 | -0.417633 | 0.122654 |

| 1 | 2010-01-03 | 1 | True | 13.386595 | 13.386595 | 2010-01-03 | 13.386595 | 0.219882 | -0.318452 | 0.117500 | -0.417633 | 0.122654 |

| 2 | 2010-01-03 | 2 | True | 13.386595 | 13.386595 | 2010-01-03 | 13.386595 | 0.219882 | -0.318452 | 0.117500 | -0.417633 | 0.122654 |

| 3 | 2010-01-03 | 3 | True | 13.386595 | 13.386595 | 2010-01-03 | 13.386595 | 0.219882 | -0.318452 | 0.117500 | -0.417633 | 0.122654 |

| 4 | 2010-01-10 | 0 | True | 13.624218 | 13.640713 | 2010-01-10 | 13.624218 | 0.219882 | -0.194838 | 0.168794 | -0.425480 | 0.110445 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 1075 | 2017-12-17 | 3 | False | 12.568616 | 12.578802 | 2017-12-17 | 12.568616 | 0.298663 | 0.248654 | -0.216869 | 0.434042 | -0.482380 |

| 1076 | 2017-12-24 | 3 | False | 12.691451 | 12.682831 | 2017-12-24 | 12.691451 | 0.328516 | 0.233616 | -0.358839 | 0.430410 | -0.373389 |

| 1077 | 2017-12-31 | 3 | False | 12.769532 | 12.732890 | 2017-12-31 | 12.769532 | 0.503457 | 0.069313 | -0.092571 | 0.456087 | -0.553539 |

| 1078 | 2018-01-07 | 3 | False | 12.908227 | 12.911066 | 2018-01-07 | 12.908227 | 0.527849 | 0.051295 | 0.029532 | 0.471673 | -0.456456 |

| 1079 | 2018-01-14 | 3 | False | 12.777193 | 12.695408 | 2018-01-14 | 12.777193 | 0.465717 | 0.032946 | 0.006275 | 0.480271 | -0.352770 |

1080 rows × 12 columns

Backtest Scoring¶

The main purpose of BackTester are the evaluation metrics. Some of the most widely used metrics are implemented and built into the BackTester API.

The default metric list is smape, wmape, mape, mse, mae, rmsse.

[19]:

bt.score()

[19]:

| metric_name | metric_values | is_training_metric | |

|---|---|---|---|

| 0 | smape | 0.006231 | False |

| 1 | wmape | 0.006221 | False |

| 2 | mape | 0.006212 | False |

| 3 | mse | 0.012160 | False |

| 4 | mae | 0.079023 | False |

| 5 | rmsse | 0.787080 | False |

It is possible to filter for only specific metrics of interest, or even implement your own callable and pass into the score() method. For example, see this function that uses last observed value as a predictor and computes the mse. Or naive_error which computes the error as the delta between predicted values and the training period mean.

Note these are not really useful error metrics, just showing some examples of callables you can use ;)

[20]:

def mse_naive(test_actual):

actual = test_actual[1:]

predicted = test_actual[:-1]

return np.mean(np.square(actual - predicted))

def naive_error(train_actual, test_predicted):

train_mean = np.mean(train_actual)

return np.mean(np.abs(test_predicted - train_mean))

[21]:

bt.score(metrics=[mse_naive, naive_error])

[21]:

| metric_name | metric_values | is_training_metric | |

|---|---|---|---|

| 0 | mse_naive | 0.019628 | False |

| 1 | naive_error | 0.226995 | False |

It doesn’t take additional time to refit and predict the model, since the results are stored when fit_predict() is called. Check docstrings for function criteria that is required for it to be supported with this api.

In some cases, we may want to evaluate our metrics on both train and test data. To do this you can call score again with the following indicator

[22]:

bt.score(include_training_metrics=True)

[22]:

| metric_name | metric_values | is_training_metric | |

|---|---|---|---|

| 0 | smape | 0.006231 | False |

| 1 | wmape | 0.006221 | False |

| 2 | mape | 0.006212 | False |

| 3 | mse | 0.012160 | False |

| 4 | mae | 0.079023 | False |

| 5 | rmsse | 0.787080 | False |

| 6 | smape | 0.002689 | True |

| 7 | wmape | 0.002684 | True |

| 8 | mape | 0.002687 | True |

| 9 | mse | 0.002976 | True |

| 10 | mae | 0.034300 | True |

Backtest Get Models¶

In cases where BackTester doesn’t cut it or for more custom use-cases, there’s an interface to export the TimeSeriesSplitter and predicted data, as shown earlier. It’s also possible to get each of the fitted models for deeper diving

[23]:

fitted_models = bt.get_fitted_models()

[24]:

model_1 = fitted_models[0]

model_1.get_regression_coefs()

[24]:

| regressor | regressor_sign | coefficient | |

|---|---|---|---|

| 0 | trend.unemploy | Regular | -0.049398 |

| 1 | trend.filling | Regular | -0.033685 |

| 2 | trend.job | Regular | 0.274851 |

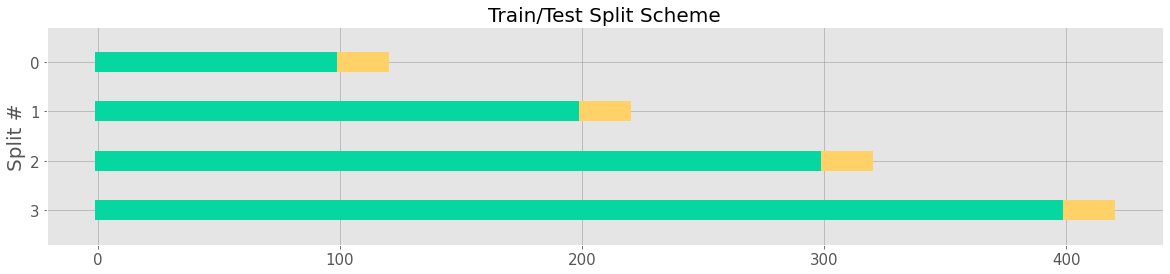

BackTester composes a TimeSeriesSplitter within it, but TimeSeriesSplitter can also be created on its own as a standalone object. See section below on TimeSeriesSplitter for more details on how to use the splitter.

All of the additional TimeSeriesSplitter args can also be passed into BackTester on instantiation

[25]:

ts_splitter = bt.get_splitter()

_ = ts_splitter.plot()

Hyperparameter Tunning¶

After seeing the results fromt the backtest, users may wish to fine tune the hyperparmeters. Orbit also provide a grid_search_orbit utilities for parameter searching. It uses Backtester under the hood so users can compare backtest metrics for different paramters combination.

[28]:

from orbit.diagnostics.backtest import grid_search_orbit

# defining the search space for level smoothing paramter and seasonality smooth paramter

param_grid = {

'level_sm_input': [0.3, 0.5, 0.8],

'seasonality_sm_input': [0.3, 0.5, 0.8],

}

[28]:

# configs

min_train_len = 380 # in case of rolling window, this specify the length of window length

forecast_len = 20 # length forecast window

incremental_len = 20 # step length for moving forward

best_params, tuned_df = grid_search_orbit(param_grid,

model=dlt,

df=data,

min_train_len, incremental_len, forecast_len,

metrics=None, criteria=None, verbose=True)

0%| | 0/9 [00:00<?, ?it/s]

tuning hyper-params {'level_sm_input': 0.3, 'seasonality_sm_input': 0.3}

11%|█ | 1/9 [00:00<00:03, 2.51it/s]

tuning metric:0.0069549

tuning hyper-params {'level_sm_input': 0.3, 'seasonality_sm_input': 0.5}

22%|██▏ | 2/9 [00:00<00:02, 2.49it/s]

tuning metric:0.0064769

tuning hyper-params {'level_sm_input': 0.3, 'seasonality_sm_input': 0.8}

33%|███▎ | 3/9 [00:01<00:02, 2.49it/s]

tuning metric:0.0062834

tuning hyper-params {'level_sm_input': 0.5, 'seasonality_sm_input': 0.3}

44%|████▍ | 4/9 [00:01<00:02, 2.37it/s]

tuning metric:0.0074489

tuning hyper-params {'level_sm_input': 0.5, 'seasonality_sm_input': 0.5}

56%|█████▌ | 5/9 [00:02<00:01, 2.39it/s]

tuning metric:0.0070464

tuning hyper-params {'level_sm_input': 0.5, 'seasonality_sm_input': 0.8}

67%|██████▋ | 6/9 [00:02<00:01, 2.25it/s]

tuning metric:0.0066297

tuning hyper-params {'level_sm_input': 0.8, 'seasonality_sm_input': 0.3}

78%|███████▊ | 7/9 [00:03<00:01, 1.95it/s]

tuning metric:0.0094182

tuning hyper-params {'level_sm_input': 0.8, 'seasonality_sm_input': 0.5}

89%|████████▉ | 8/9 [00:03<00:00, 1.85it/s]

tuning metric:0.0088091

tuning hyper-params {'level_sm_input': 0.8, 'seasonality_sm_input': 0.8}

100%|██████████| 9/9 [00:04<00:00, 2.05it/s]

tuning metric:0.0078637

[29]:

tuned_df.head() # backtest output for each parameter searched

[29]:

| level_sm_input | seasonality_sm_input | metrics | |

|---|---|---|---|

| 0 | 0.3 | 0.3 | 0.006955 |

| 1 | 0.3 | 0.5 | 0.006477 |

| 2 | 0.3 | 0.8 | 0.006283 |

| 3 | 0.5 | 0.3 | 0.007449 |

| 4 | 0.5 | 0.5 | 0.007046 |

[30]:

best_params # output best parameters

[30]:

[{'level_sm_input': 0.3, 'seasonality_sm_input': 0.8}]